I am staying on the finances of climate change. The last post related to the IMF (International Monetary Fund) warning that:

“nations must do all they can to promote a recovery that also fights against the climate-change crisis”

More and more pressure is coming to bear on investors to take into consideration the risk of directing capital to assets that contribute to destroying our atmosphere/climate. It’s getting harder and harder to put one’s head in the sand and ignore financial instruments that will continue to become increasingly devalued the greater the recognition that they are contributing to the emissions of climate warming elements. And sooner or later the value of these assets will fall off the cliff.

This time it’s the S&P and Dow Jones that have developed indices to help investors and funders identify and

“manage climate change-related risks and opportunities.”

“The indices are the latest tool asset managers can use to gauge the environmental sustainability of their investments.”

“The indices “provide transparency with respect to these consequences and investment strategies that address climate change risks and opportunities,””

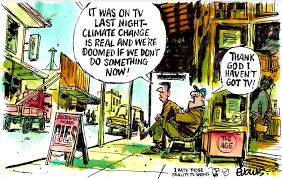

Unless you’re the Republican Party or your name is Trump, it is becoming harder and harder to ignore the climate crisis and the financial consequences of investing in any entity which is exacerbating it and the financial peril you take the longer you wait to divest.

Investment Indices Focus on Companies with Falling CO2

Corbin Hiar, E&E Reporter

April 21, 2020

The company that manages the widely cited S&P 500 and Dow Jones Industrial Average indices is rolling out new products to help investors manage climate change-related risks and opportunities.

The Climate Transition Index and Paris-Aligned Climate Index were created by S&P Dow Jones Indices LLC (DJI) based on European Union sustainable finance guidelines.

“There is a growing urgency in Europe and globally to identify solutions that address the negative consequences companies and institutions face due to climate change,” said Reid Steadman, head of sustainable investing at DJI.

The indices “provide transparency with respect to these consequences and investment strategies that address climate change risks and opportunities,” he said yesterday in a press release.

Both require companies to reduce their annual carbon emissions by at least 7% and have limited exposure to the “physical risks from climate change,” according to the indices’ methodology. They are also heavily focused on tracking “potential climate change opportunities.”

The most heavily weighted companies in the Europe-focused indices are, respectively, SAP SE, a German software giant, and ASML Holding NV, a Dutch semiconductor maker, according to data provided to E&E News. Other companies that are well-represented in both portfolios are French luxury goods conglomerate LVMH Moët Hennessy-Louis Vuitton SE, German automation firm Siemens AG, the British-Dutch consumer goods maker Unilever NV and the Spanish electric utility Iberdrola SA.

DJI intends for the portfolio of companies in its Climate Transition Index to be at least 30% less carbon intensive than its S&P Eurozone LargeMidCap Index.

Meanwhile, DJI’s Paris index is guided by the United Nations’ Paris Agreement, in which most countries vowed to pursue policies to limit global average temperature increases to less than 1.5 degrees Celsius, or 2.7 degrees Fahrenheit. It is supposed to be at least 50% less carbon intensive than DJI’s broader European index.

The Paris portfolio also aims to exclude companies that derive more than 1% of their revenues from coal, 10% from oil or 50% from natural gas.

In the coming months, DJI plans to launch additional climate-focused indices of companies based in the United States and other developed countries.