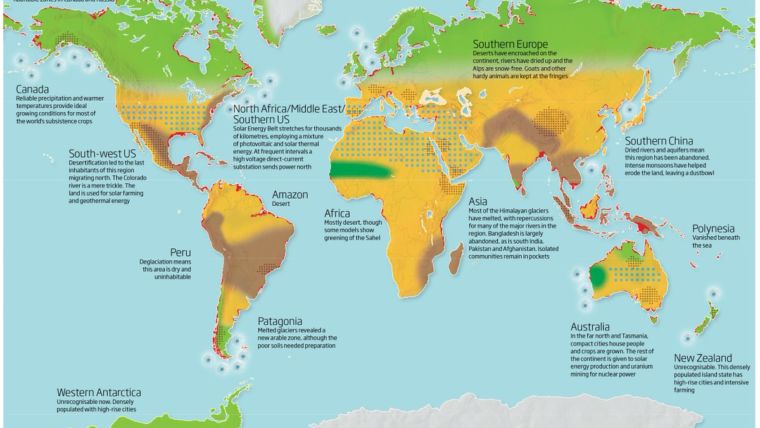

Two themes that I have written about a great deal come together in this article. One is that risk of climate change is increasingly becoming factored into financial markets and financial decisions. I’ve cautioned about being invested in fossil fuel industry assets especially those companies that have trillions of dollars of fossil fuels on their balance sheets that could end…