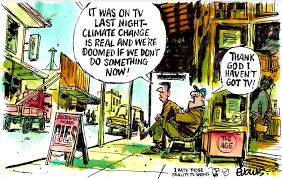

Last week I wrote about the multitude of articles showing how our country is waking up to the climate crisis and beginning to react. None too soon because the consequences are becoming not only worse but converging. Or, as the following article describes, cascading. The article from the NYT is a bit long and honestly, scary and depressing as…